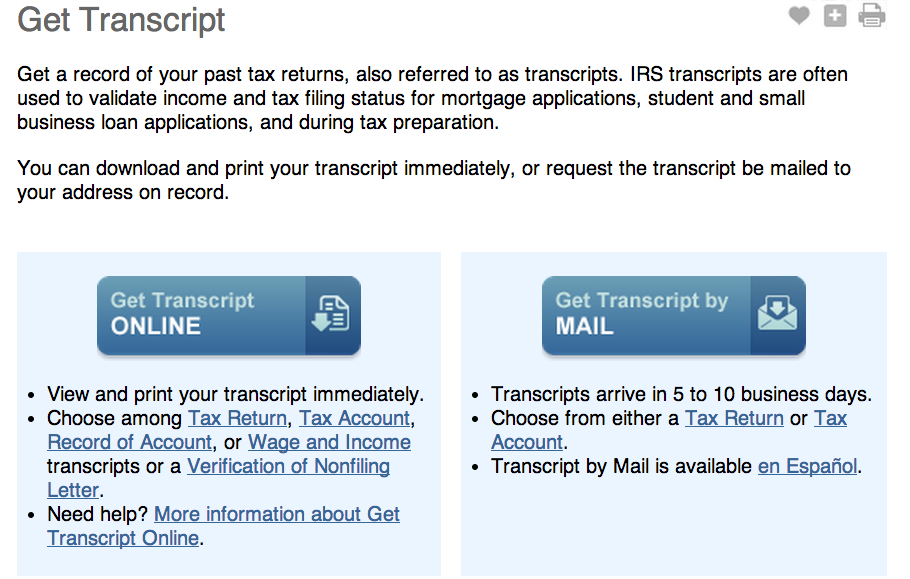

A common question our firm gets asked is How to Request a Tax Transcript From the IRS? Filing an error-free tax return is key to taxpayers getting any refund they are due as soon as possible. Using Online Account on the IRS website is the fastest and easiest way to see account information such as estimated […]

Curious about Tax Breaks for Teachers? It’s almost time for the start of the new school year, and teachers and other educators should know that they can still deduct certain unreimbursed expenses. Deducting expenses such as classroom supplies, training, and travel helps reduce the amount of tax owed when filing a tax return. Teachers and […]

One of the most important questions you face when changing jobs is what to do with the money in your 401(k) because making the wrong move could cost you thousands of dollars or more in taxes and lower returns. Let’s say you put in five years at your current job. For most of those years, […]

A cash windfall is any amount of money that you didn’t expect to receive and is over your regular income. Most would consider it to be any amount over $1,000 – and quite often, the amount of money is much more than that. For example, you may have received a bonus at work, an inheritance, […]

What is a Roth IRA? A Roth IRA is a type of IRA that allows you to make after-tax contributions instead of pretax contributions, such as those you might make with your own IRA or your employer’s 401(k). While a regular IRA and a Roth IRA are similar in many respects, it’s important that the […]

What are Qualified Charitable Distributions From IRAs? If you’re a retiree aged 70 1/2 or older, consider taking advantage of legislation that allows you to reduce or eliminate the amount of income tax on IRA withdrawals transferred directly to a qualified charitable organization. You can use this tactic even though minimum distributions are no longer […]

As a reminder, taxpayers have the right to pay only the amount of tax legally due, including interest and penalties. They also have the right to have the IRS apply all tax payments properly. This is one of 10 fundamental rights known collectively as the Taxpayer Bill of Rights. The Taxpayer Bill of Rights (TBOR) […]

April 11 Employees who work for tips – If you received $20 or more in tips during March, report them to your employer. You can use Form 4070. April 18 Individuals – File an income tax return for 2021 (Form 1040 or Form 1040-SR) and pay any tax due. If you live in Maine or […]

Generally, taxpayers should file their tax returns by the deadline even if they cannot pay the total amount due, but if you can’t, there are several options. Let’s take a look at a few scenarios: 1. An individual taxpayer owes taxes but can’t pay in full by the deadline. If this is the case, file a […]

Cash flow is the lifeblood of every small business but many business owners underestimate just how vital managing cash flow is to their business’s success. In fact, a healthy cash flow is more important than your business’s ability to deliver its goods and services. While that might seem counterintuitive, consider this: if you fail to […]