How to Request a Tax Transcript From the IRS

A common question our firm gets asked is How to Request a Tax Transcript From the IRS?

Filing an error-free tax return is key to taxpayers getting any refund they are due as soon as possible. Using Online Account on the IRS website is the fastest and easiest way to see account information such as estimated tax payments, prior year adjusted gross income, and economic impact payment amounts. Taxpayers who don’t have an account will need to create one.

Taxpayers can also request a tax transcript, free of charge. There are five types of transcripts:

- Tax Return Transcript

- Tax Account Transcript

- Record of Account Transcript

- Wage and Income Transcript

- Verification of Non-filing Letter

Each transcript type should be reviewed by the taxpayer to determine which one best meets their needs. Don’t hesitate to call the office if you need help with this.

IRS transcripts are a good way to check for fraudulent activity. However, ordering a transcript will not help them find out when they will get their refund. The Where’s My Refund? tool provides the most up-to-date details about whether a tax return has been received and if the IRS has approved or sent the refund.

To protect taxpayers’ identities, the transcripts partially hide personally identifiable information such as names, addresses, and Social Security numbers. All financial entries are fully visible.

There are three ways taxpayers can get transcripts:

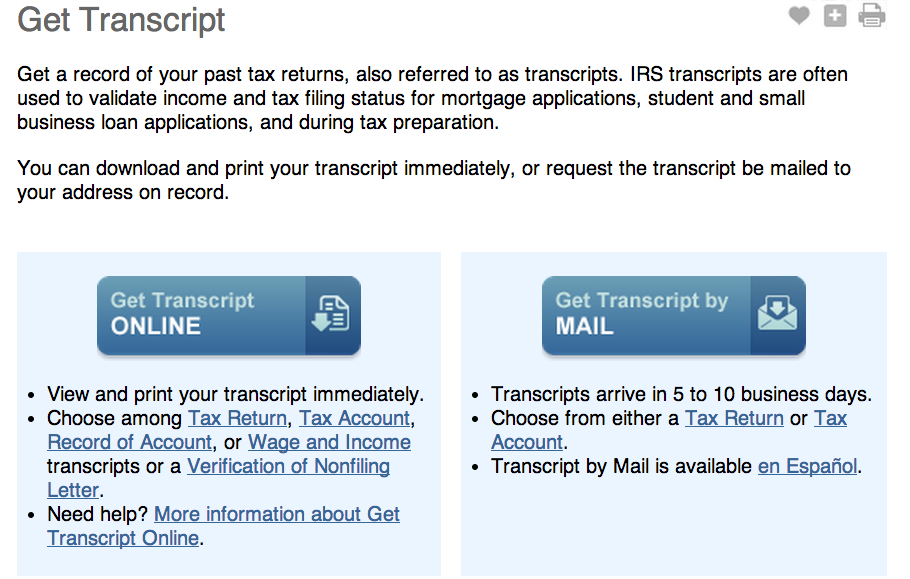

Online. People can view their tax records in their Online Account, as well as visit Get Transcript Online to view, print, or download all transcript types.

By mail. Taxpayers can use Get Transcript by Mail to get a tax return or tax account transcript delivered within 5-10 calendar days. They can also submit Form 4506-T to request any transcript type. Most Form 4506-T transcript requests are processed within 10 business days and then mailed. Form 4506-T is available on IRS.gov’s Forms, Instructions, and Publications page.

By phone. Taxpayers can call the IRS’s automated phone transcript service at 800-908-9946 to get a tax return or tax account transcript delivered by mail within 5-10 calendar days.

Please contact the Offices of Rex Crandell Firm if you have questions about how to Request a Tax Transcript

As always, help is just a phone call away – 925-934-6320

You can also schedule a consultation by clicking here!